Top 5 Heron Data Alternatives in 2025

Break free from Heron Data's limitations. Compare against the top document processing tools that offer higher accuracy, and versatile lending automation capabilities.

Get Started

.svg)

Docsumo Lending DocAI vs Heron Data

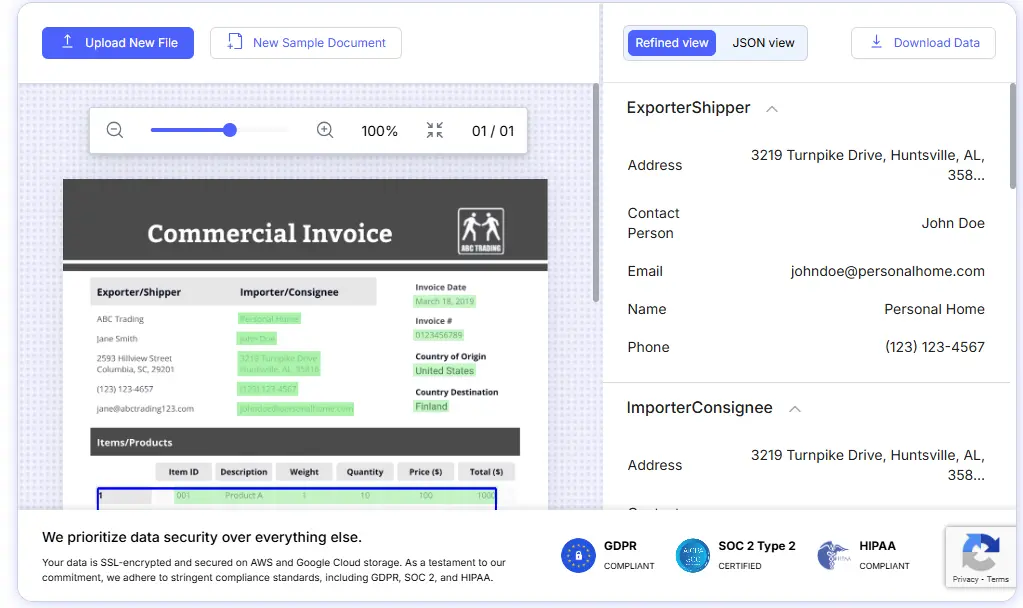

- Processing accuracy: Heron Data achieves 91% accuracy for financial documents, while Docsumo Lending DocAI delivers 95-99% accuracy with proven straight-through processing rates above 95%.

- Industry focus: Heron Data specializes exclusively in financial services with 50+ pre-trained models for lending and insurance, whereas Docsumo Lending DocAI offers broader document support beyond financial services with AI agents for various lending workflows.

- User interface: Heron Data provides a clean dashboard interface with basic review capabilities, but Docsumo offers an intuitive Excel-like interface with comprehensive document reviewer screens and AI agent management.

- Pricing: Heron Data uses custom quotation-based pricing without transparency, while Docsumo provides usage-based pricing starting from $0.15 per 1,000 pages with clear cost structure.

- Integration capabilities: Heron Data connects with 20+ systems including lending platforms and CRMs, however Docsumo enables broader integration via APIs, email parsing, cloud drives, and multiple third-party connectors.

Verdict

Heron Data suits businesses with basic accuracy requirements and more specialized workflow needs, while Docsumo Lending DocAI is better for organizations seeking higher accuracy, transparent pricing, and versatile lending automation.

Amazon Textract vs Heron Data

- Extraction capabilities: Heron Data specializes in complex financial documents with industry-specific templates, while Amazon Textract offers broader document understanding including forms, tables, and natural language queries with 93% accuracy.

- Processing accuracy: Heron Data achieves 91% accuracy for financial documents, while Amazon Textract delivers 93% accuracy with strengths in printed text but lower performance on handwritten content.

- Ease of use: Heron Data provides dashboard-based workflow management with human review capabilities, whereas Amazon Textract is entirely API-driven requiring developer expertise without native document review interface.

- Integration ecosystem: Heron Data offers direct integrations with 20+ financial systems and CRMs, but Amazon Textract integrates deeply with AWS services like S3, Lambda, and SQS for scalable workflows.

- Pricing: Heron Data requires custom quotations without published rates, whereas Amazon Textract offers transparent pay-per-page pricing at $1.50 per 1,000 pages.

Verdict

Heron Data is ideal for financial services requiring specialized document workflows, while Amazon Textract suits AWS-centric enterprises needing flexible, cost-effective document extraction capabilities.

Google Document AI vs Heron Data

- Processing accuracy: Heron Data delivers 91% accuracy on financial documents, while Google Document AI achieves 93% OCR accuracy with consistent performance across diverse document types.

- Target market: Heron Data focuses exclusively on enterprise financial services clients, whereas Google Document AI serves businesses of all sizes with scalable cloud-native architecture.

- Custom model training: Heron Data requires team involvement for custom model configuration, but Google Document AI offers Document AI Workbench for independent custom model development though with technical complexity.

- Pricing: Heron Data uses opaque custom pricing requiring quotations, whereas Google Document AI provides clear pay-as-you-go pricing at $1.50 per 1,000 pages for basic processing.

- Deployment options: Heron Data operates as a managed service with limited deployment flexibility, while Google Document AI offers cloud-native architecture with seamless integration to Google Cloud ecosystem.

Verdict

Heron Data excels for large financial institutions requiring specialized support, while Google Document AI provides better scalability, transparency, and cost-effectiveness for diverse business needs.

Omni AI vs Heron Data

- Processing accuracy: Heron Data delivers 91% accuracy for complex financial documents, while Omni AI achieves 87% document processing accuracy with vision-based model approach.

- Document specialization: Heron Data offers 50+ pre-trained models specifically for financial services documents, while Omni AI focuses on financial document processing with vision-based models achieving 87% accuracy.

- User interface: Heron Data provides clean dashboard interface with submission-based workflow management, whereas Omni AI emphasizes API-first design with limited UI components for document review.

- Pricing: Heron Data uses custom enterprise pricing without transparency, but Omni AI offers structured tier-based pricing starting at $225/month for 5,000 pages.

- Integration capabilities: Heron Data supports 20+ direct integrations with financial platforms, however Omni AI provides basic integrations with Google Sheets, Excel, and limited third-party connections.

Verdict

Heron Data suits large financial enterprises requiring comprehensive workflow management, while Omni AI is better for organizations with developer resources needing specialized financial document processing.

Ocrolus vs Heron Data

- Processing accuracy: Heron Data achieves 91% accuracy with automated processing, while Ocrolus combines machine learning with human-in-the-loop validation to deliver 90%+ accuracy with manual verification.

- Industry focus: Heron Data serves multiple financial sectors including lending and insurance with 50+ document types, whereas Ocrolus specializes exclusively in financial services with focus on cash flow analytics and fraud detection.

- Document handling: Heron Data processes complex financial documents with automated workflows, while Ocrolus specializes in financial document processing with additional authenticity scoring and tampering detection.

- Analytics capabilities: Heron Data provides basic analytics and processing metrics in dashboard, but Ocrolus offers advanced cash flow analytics, income calculations, and fraud detection for deeper financial insights.

- Pricing: Heron Data uses custom quotation-based pricing without published rates, whereas Ocrolus also employs custom pricing models without transparent rate structures.

Verdict

Heron Data provides broader financial services automation with workflow management, while Ocrolus excels for institutions requiring highest accuracy with human verification and specialized fraud detection capabilities.

"Docsumo is the best"

- That's What They Said

.webp)

.svg)

“We're a Brazilian startup structuring labor lawsuit data for tax compliance, Docsumo is the only platform that truly met our needs...”

.svg)

“Customer Support, implementation Support, User-Friendly Interface, API Integration Flexibility, Bug Free...”

.svg)

“It’s incredibly efficient—cutting manual data extraction time by up to 90%. Raghu and the team are proactive, friendly, and always go above and beyond to support us...”

5 Reasons To Choose Docsumo over Heron Data

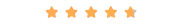

Ready-to-use models - Skip the setup sprint

Docsumo's 50+ pre-trained lending models get your underwriting team processing bank statements, tax returns, and financial documents instantly. While Heron Data requires weeks of custom setup and dedicated team involvement. With Lending DocAI, your credit team starts extracting loan data from day one.

OCR that actually reads between the lines

Docsumo's 95-99% accuracy on financial documents means fewer manual corrections and faster time-to-close. Heron Data's 97% accuracy sounds close, but those extra percentage points translate to hundreds of hours saved monthly in loan processing - critical when borrowers demand speed.

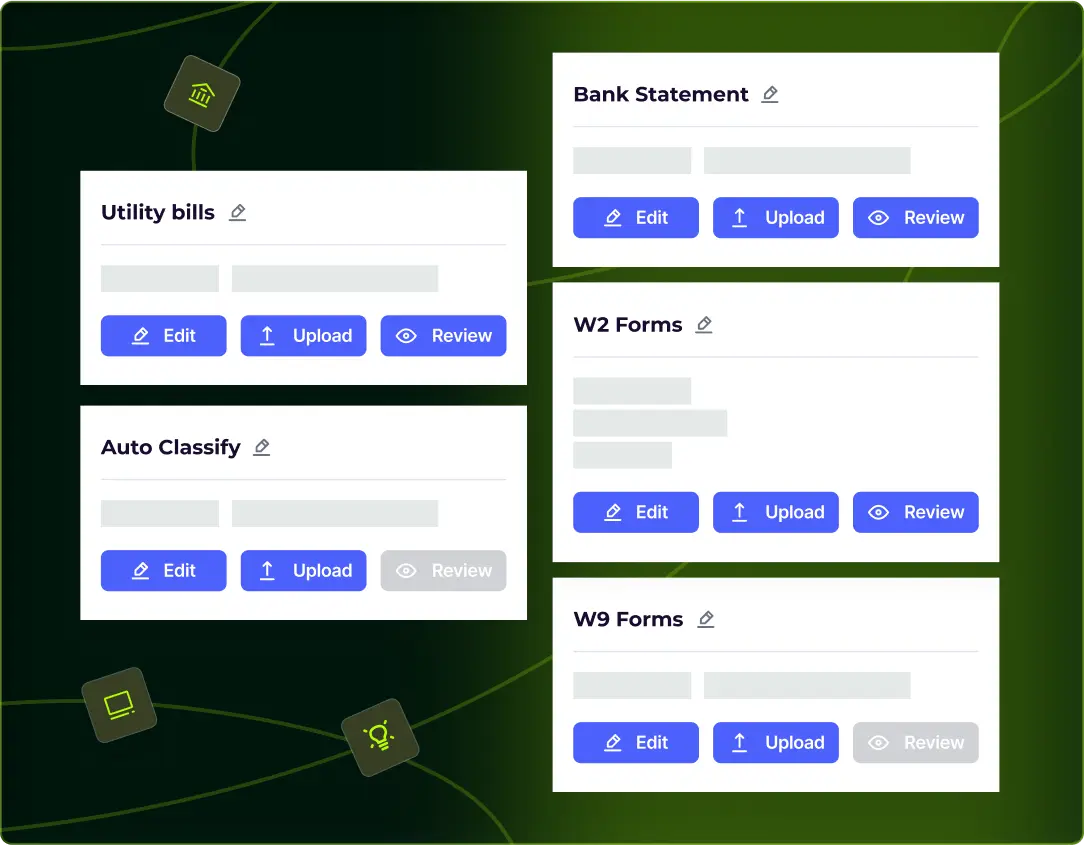

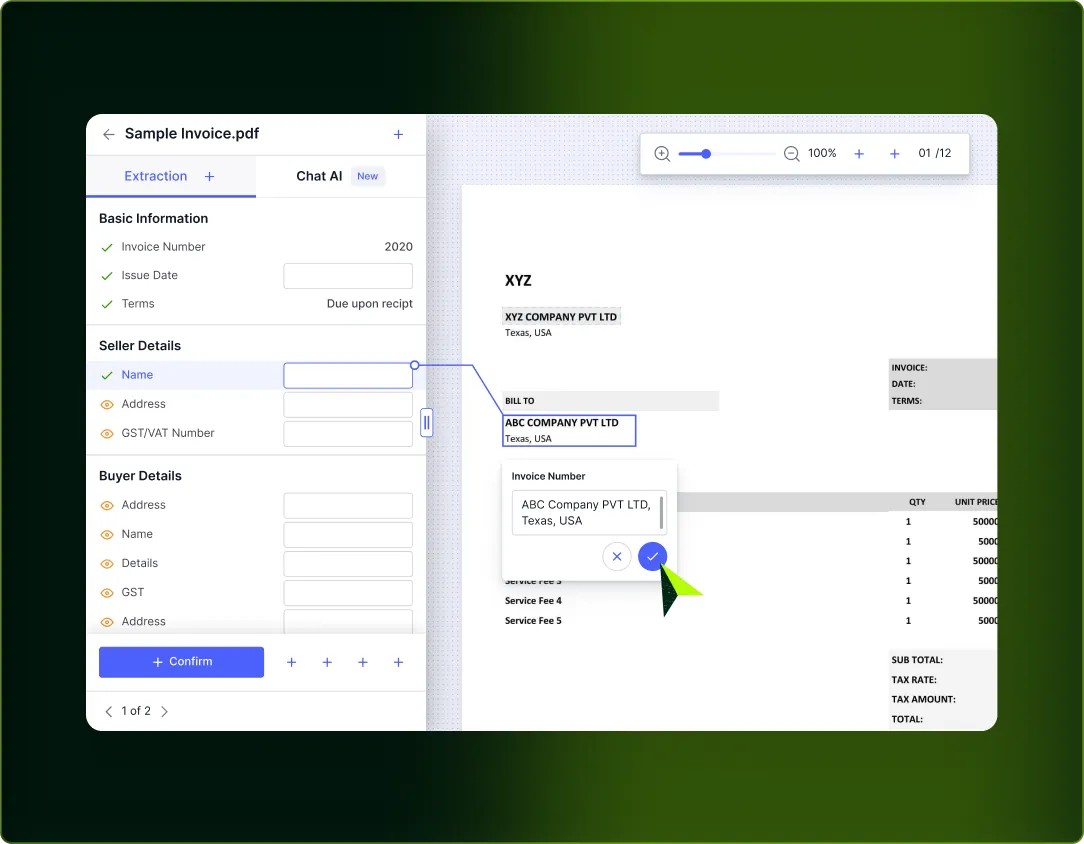

Interface that feels like you've used it before

Docsumo's Excel-like interface feels instantly familiar to lending professionals. Review bank transactions, validate income calculations, and spot fraud indicators with simple clicks. No more wrestling with Heron Data's submission-based workflows that require extensive training.

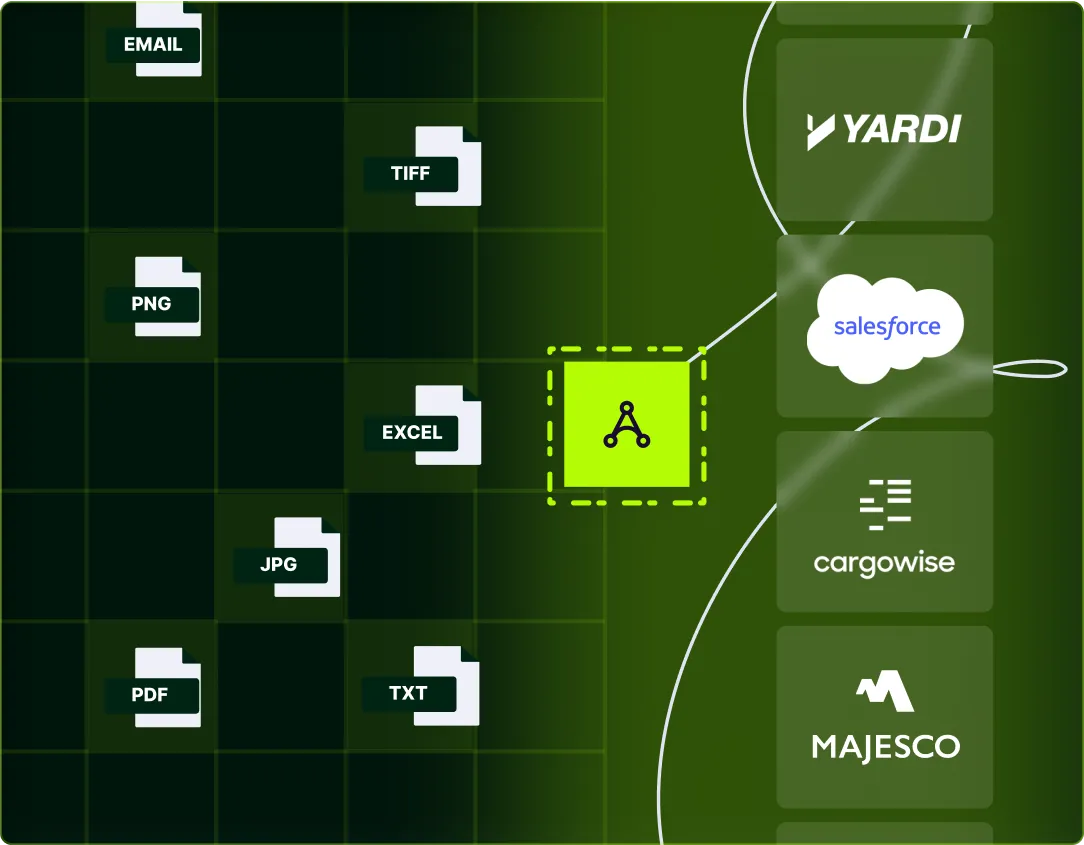

Plug and play with your favourite tools

Seamlessly integrate with 50+ tools, including Encompass, nCino, Salesforce, and QuickBooks. While Heron Data limits you to 20+ financial-focused integrations, Docsumo's robust APIs work with any LOS, core banking system, or credit decisioning platform.

Scale up exactly how you planned

Docsumo adapts as your financial services expand - from mortgage origination to insurance underwriting to wealth management. While Heron Data locks you into narrow lending workflows, Docsumo's versatile platform handles new document types and business lines as you scale.

.svg)

.webp)

.webp)